Applicability of Tax Audit U/s 44AB

Tax audit is an examination or review of accounts of any business or profession carried out by taxpayers from an income tax viewpoint. It makes the process of income computation for filing of return of income easier

In a case where a person carries business

The section 44AB(a) says that the person carrying business, would required to get his accounts audited if his Total sales/turnover/gross receipts exceeds Rs. 1 crore in the previous year.

However, that this section shall not be applicable to the person who declares profit under Section 44AD and has the total sales/turnover/gross receipts less than Rs. 2 crore.

So now the question arises that when a person is required to get his accounts audited. The answer to this question is as under.

- First of all, the person having the Turnover less than 1 crore is not required to get his accounts audit.

- Secondly, if the turnover exceeds the limit of Rs.1 crore but up to Rs. 2 crore is having an option to avail the benefit of Section 44AD (1) and avoid the audit, if he don’t want to avail the option of Section 44AD (1), then he required to get his accounts audited.

- Thirdly, the person having the Turnover more than Rs.2 crore is required to get his accounts audited.

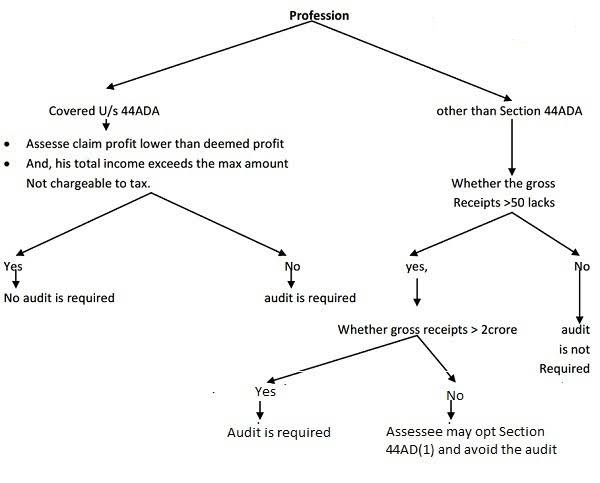

In a case where a person carries profession

The section 44AB(b) says that where a person carries profession is required to get his accounts audited if the gross receipts in the previous year exceeds Rs. 50 lakhs.

The section 44AB (d) says that where a person carries profession, declares profit U/S 44ADA, and declares the profit less than the deemed profit and his total income exceeds the limit which is not chargeable to tax, then he requires to get his accounts audited U/s 44AB (d).

FAQ on Tax Audit

1. What are form no. 3CA/3CB and 3CD?

| Form 3CA | Form 3CB | Form 3CD |

| For professionals/businesses requiring mandatory audit under law other than Income Tax law | For those not requiring mandatory audit under any law apart from Income Tax Law | Detailed form with fields featuring different audit information |

| Single Page form containing audit details obtained from multiple documents such as Balance Sheet, Form 3CD, P&L Statement, etc. | Single Page form containing income details of document obtained from multiple documents such as Balance Sheet, P&L Statement, etc. | Detailed audit report form featuring multiple fields that need to be filled out with specific details such as revenue, turnover, expenses, profits, asset-liability details and much more. |

| Can be submitted by any applicable tax assessee irrespective of income/turnover | Only tax assesses with income exceeding Rs. 1 crore who have not opted for presumptive tax mechanism can file this form. | This document is applicable to all business audits and is a detailed account of all transaction carried out by the business/professional being audited |

2. What is the due date by which a taxpayer should get his accounts audited?

A person covered by Section 44AB should get his accounts audited and should obtain the audit report on or before the due date of filing of the return of income, i.e., on or before 30th September(*) of the relevant Assessment Year, e.g., Tax audit report for the Financial Year 2019-20 corresponding to the Assessment Year 2020-21 should be obtained on or before 30th September, 2020.

The tax audit report is to be electronically filed by the chartered accountant to the Income-tax Department. After filing of report by the chartered accountant, the taxpayer has to approve the report from his e-fling account with Income-tax Department (i.e., at www.incometaxindiaefiling.gov.in).

Note: (*) In case of a taxpayer who is required to furnish a report in Form No. 3CEB under Section 92 in respect of any international transaction or specified domestic transaction, the due date of filing the return of income is 30th November of the relevant assessment year.

3. What is Form 3CEB?

Form 3CEB is basically filled by the company with Form 3CD under sec 92A TO 92F of income tax act. These section basically relating to TRANSFER PRICING, Form 3CEB is mandatory to filled if the company engaged in any of the international transaction with any associate enterprise.

4. What is the penalty for not getting the accounts audited as required by Section 44AB?

According to Section 271B, if any person who is required to comply with Section 44AB, fails to get his accounts audited in respect of any year or years or furnish such report as required as required under Section 44AB, the Assessing Officer may impose a penalty. The penalty shall be lower of the following amounts:

(a) 0.5% of the total sales, turnover or gross receipts, as the case may be, in business, or of the gross receipts in profession, in such year or years.

(b) Rs. 1,50,000.

However, according to Section 271B, no penalty shall be imposed if reasonable cause for such failure is proved.