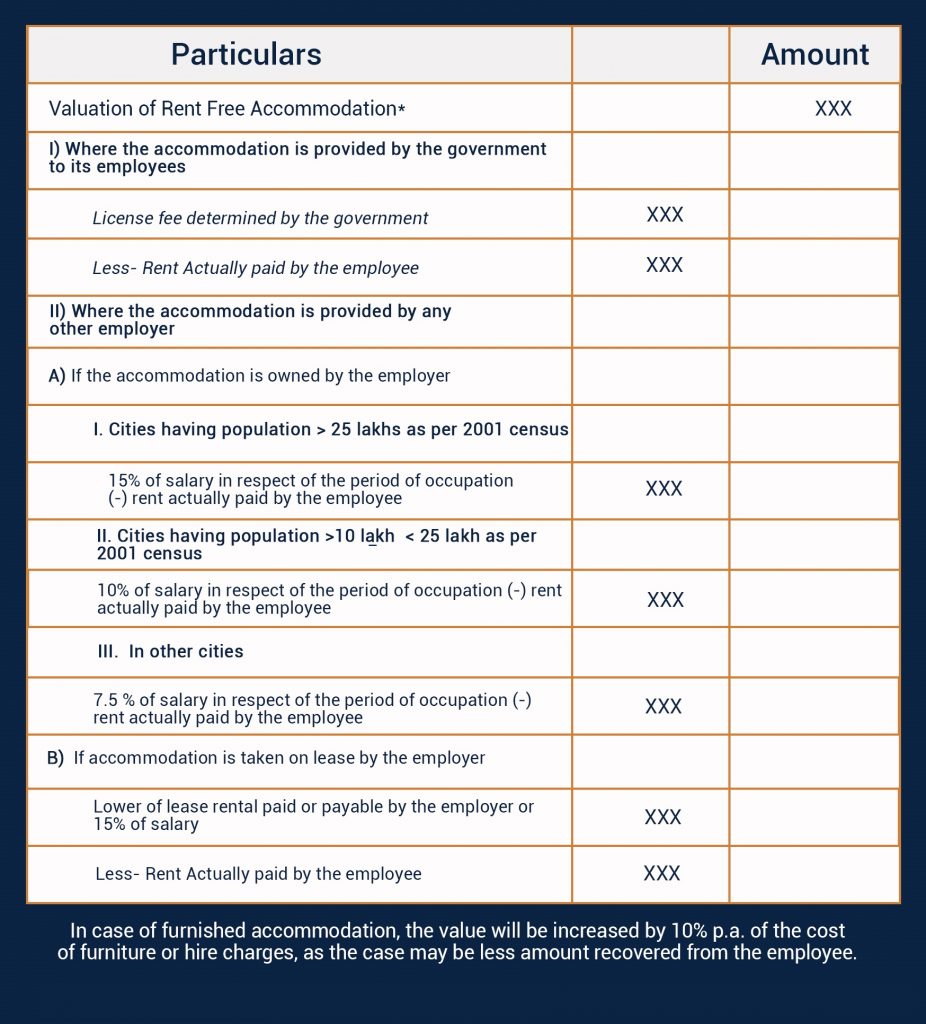

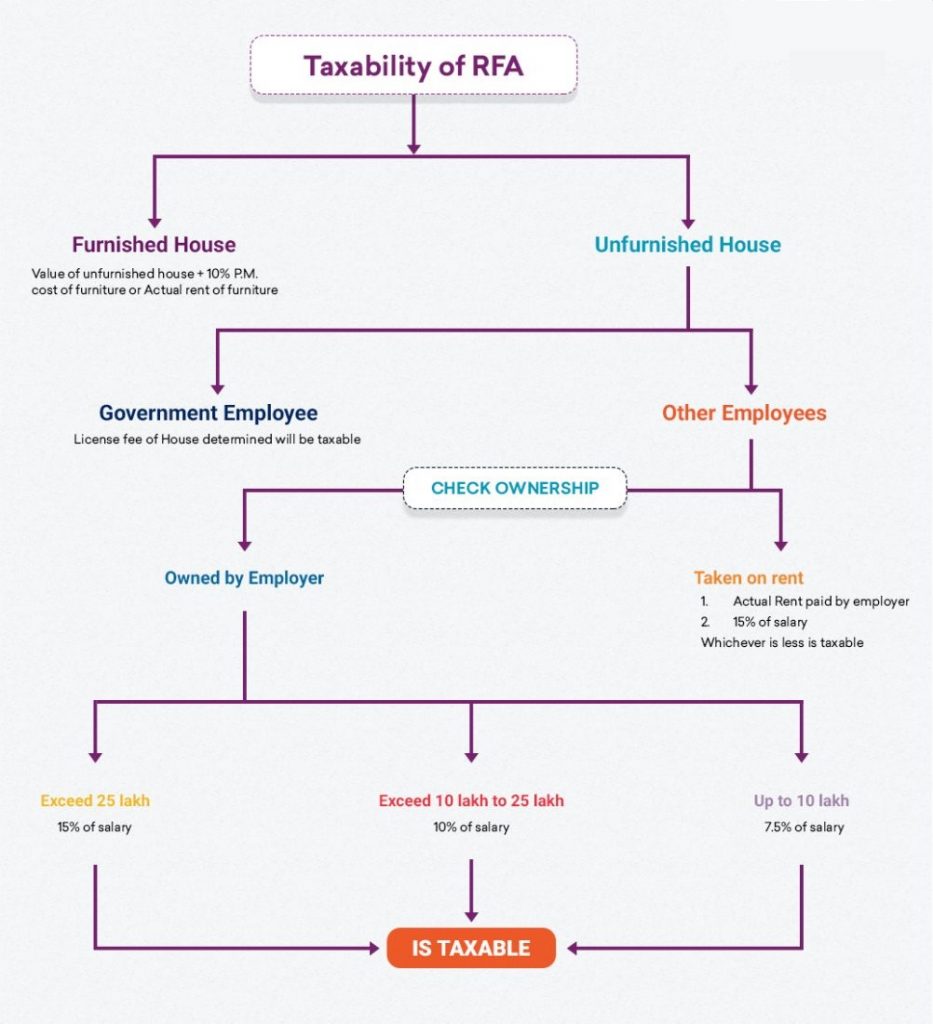

Valuation of Rent Free Accommodation-

The value of residential accommodation provided by the employer directly or indirectly to the assessee or to any other member of his household by reason of his employment, shall be determined in the following manner:

1. When accommodation is provided by the government to its employees holding office/post in connection with government affairs

| In Case Accommodation is unfurnished | In case Accommodation is furnished |

| License Fee determined by the government has reduced by the rent actually paid by the employee | The value calculated will be increased by- 10% p.a. of the cost of furniture if owned by employer or actual hire charges table in case the furniture is taken on hire. Any charges recovered from the employee shall be deducted. |

2- (a) When the accommodation is provided by any other employer and such accommodation is owned by the employer

| In Case Accommodation is unfurnished | In case Accommodation is furnished |

| In cities having a population- 1. exceeding 25 lacs as per 2001 census: 15% of salary 2. exceeding 10 lacs but not exceeding 25 lacs: 10% of salary 3. Not exceeding 10 lacs population: 7.5% of salary Any charges recovered from the employee shall be deducted. | The value calculated will be increased by- 10% p.a.Of the cost of furniture if owned by employer or actual hire charges payable in case the furniture is taken on hire. Any charges recovered from the employee shall be deducted. |

(b) Such accommodation is taken on lease or rent by the employer

| In Case Accommodation is unfurnished | In case Accommodation is furnished |

| Lower of- a) Actual rent paid by the employer; or b) 15% of salary; Any charges recovered from the employee shall be deducted. | Value calculated will be increased by- 10% p.a. of the cost of furniture if owned by the employer or Actual hire charges payable in case the furniture is taken on hire. Any charges recovered from the employee shall be deducted. |

3. When the accommodation is provided by the above employers in a hotel-

| In Case Accommodation is unfurnished | In case Accommodation is furnished |

| Not applicable | Lower of- a) the actual Charges paid/ payable to such hotel; or b) 24% of salary Any charges recovered from the employee shall be deducted. |

Prerequisite value shall be exempt if Accommodation provided in a Hotel:-

- Such accommodation is provided for a period not exceeding 15 days, and

- It has been provided on the transfer of the employee from one place to another.

Note- Salary includes = Basic pay+ Dearness Allowance/pay( if forms part of superannuation or retirement benefits)+ Bonus + Commission + Fees+ All taxable allowances + All monetary payments chargeable to tax, from one or more employers.