- An individual and/or Hindu undivided family (HUF) has to deduct tax at source under Section 194M. Such individuals and HUF must not be required to get their books of accounts audited. Books of Accounts are required to be audited if total turnover or receipts of a business exceed Rs 1 crore or where receipts of a profession exceed Rs 50 lakh.

Author: Pallavi Goel

Income Declaration Scheme, 2016

Govt. extends time-limit for making tax payments under IDS till 31st January, 2020.

CBDT notifies 31st Jan 2020 as the Last date for payment of pending amount under Income Declaration Scheme (IDS) 2016. Govt. notifies that persons who have made declaration under the Income Declaration Scheme, 2016, but have not made payment of tax, surcharge, penalty payable there under on or before the due dates, may now make the payments on or before the 31st January, 2020, along with interest at the rate of 1% p.m; States that this notification shall be deemed to have come into force with effect from the 1st June, 2016.

It is hereby certified that no person is being adversely affected by giving retrospective effect to this notification.

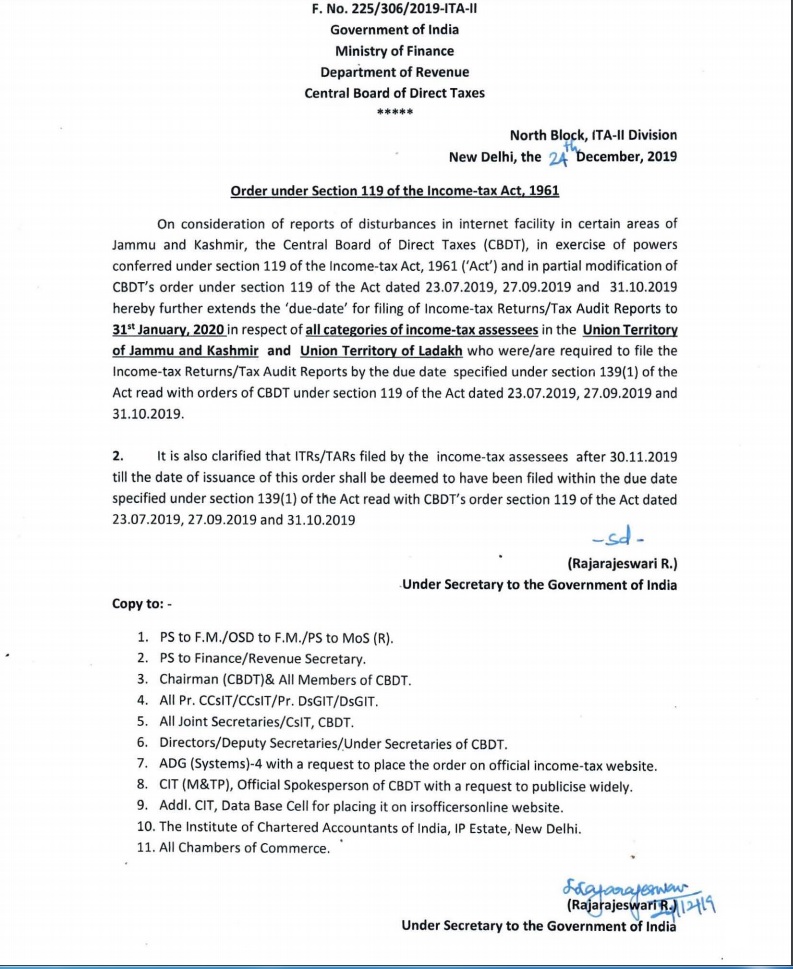

Continue reading “Income Declaration Scheme, 2016”Extension of Due Dates of Tax Audit/ Income Tax Returns for Assessee in UT of J&K and UT of Ladakh

Sec 194N- TDS on Cash Withdrawal of more than 1 Crore

As newly inserted section in the chapter of TDS requires tax to be deducted at source if any specified person withdraws Rupees more than 1 Crore from any banking company, co-operative bank or post office. This section came in force on September 1st, 2019 in order to discourage cash transactions and move towards cash-less economy.

Continue reading “Sec 194N- TDS on Cash Withdrawal of more than 1 Crore”Rent Free Accommodation?